Proposed US tariffs' minimal effect on Chinese imports

United States President Joe Biden proposed tripling of the current 7.5% Section 301 tariff on Chinese steel will have a minimal effect, MEPS analysis shows.

A final decision on additional tariffs will be made following the conclusion of a four-year review on the effectiveness of Section 301 tariffs. Section 301 tariffs currently range from 7.5% to 25% and have been applied to a variety of Chinese products since beginning in 2018.

Section 301 tariffs are levied in addition to Section 232 tariffs and antidumping and countervailing duties on various steel products from China.

Given these newly proposed steel tariffs, MEPS analysed the current state of Chinese steel imports and how the proposed tariffs might impact the US steel market.

Quantifying US’s Chinese imports

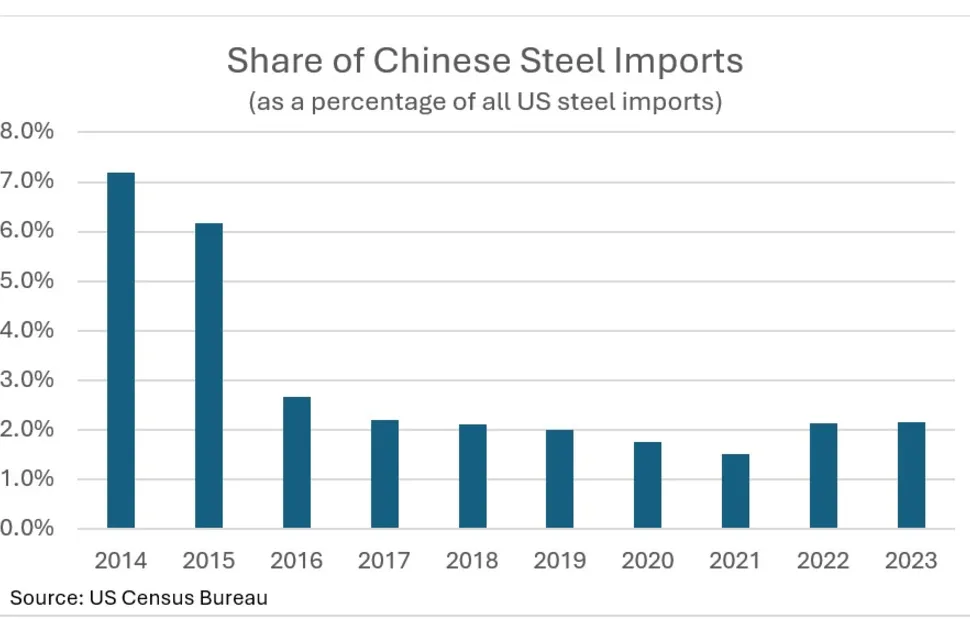

The United States imported 553,406 tonnes of steel from China last year, dropping 8% from 2022, according to the US Census Bureau. This represents approximately 2% of all US steel imports, a percentage that has remained the same since 2017. China is currently the seventh largest exporter of steel products to the US. Long products, such as wire, bars and structural, accounted for more than 45% of total imports in 2023.

Chinese-origin imports have dropped significantly from the 2014 level of 2.9 million tonnes. However, even at that level, Chinese imports represented only 7.2% of all US steel imports as the US imported over 40m tonnes that year. Canada remains the largest exporter of steel to the US, representing over 24% of total US imports, followed by Brazil and Mexico in 2023.

The weaker state of the Chinese economy and the strong increase in Chinese exports globally last year has caused concern for US steel manufacturers. Last year China exported over 90m tonnes of steel, a 36% increase year-on-year, according to China’s General Administration of Customs. The last time exports were that high was in 2016 when exports reached 108 million. Further Chinese exports were reported at 9.89 million last month, increasing 25% year-on-year and setting the stage for a stronger year of exports than 2023.

Influence of Section 301’s threefold increase

Assuming that the additional tariffs are imposed, they will have a minimal effect on the US steel market and consumers. The share of Chinese imports is small, at 2%, and the share of total US steel supply is even smaller at 0.6% (domestic supply is estimated at 97.4 million in 2023).

Additionally existing duties and tariffs are already significant. Finally, while preliminary US Department of Commerce data indicated that Chinese imports rose 60% last month, to just over 44,000 metric tonnes, this level remains in line with the 12-month average of 40,000 and should not raise alarm that Chinese imports are rising in the US market.

The impact of the proposed Section 301 tariff increase will be minimal given the significant safeguards already in place.

- Monthly insight on the United States carbon steel market is published in MEPS's International Steel Review. The country's stainless steel market is also covered in the Stainless Steel Review. These monthly reports provide subscribers with steel prices, indices, market commentary and forecasts from key global steel markets.

Source:

International Steel Review

The MEPS International Steel Review is an essential monthly publication, offering professional analysis and insight into carbon steel prices around the world.

Go to productRequest a free publication